![]()

In today’s fast-paced digital economy, convenience and security are key to handling our finances. UPI-ATM services are one of the most recent innovations introduced by the National Payments Corporation of India (NPCI). These services allow cardless cash withdrawals and deposits, transforming traditional ATM interactions. UPI-ATM services, also known as Interoperable Cardless Cash Withdrawal (ICCW) and Interoperable Cash Deposit (ICD), provide seamless, secure, and efficient banking options for users, eliminating the need for physical ATM cards.

Let’s explore how these services work, their benefits, and why they are set to revolutionize how we manage cash transactions.

What is UPI-ATM Cash Withdrawal?

UPI-ATM Cash Withdrawal is an innovative service that allows customers to withdraw cash from any UPI-enabled ATM without using a debit or credit card. All you need is a UPI-enabled app on your smartphone. This cardless approach ensures greater security and convenience for customers, especially in avoiding card theft, skimming, and lost cards.

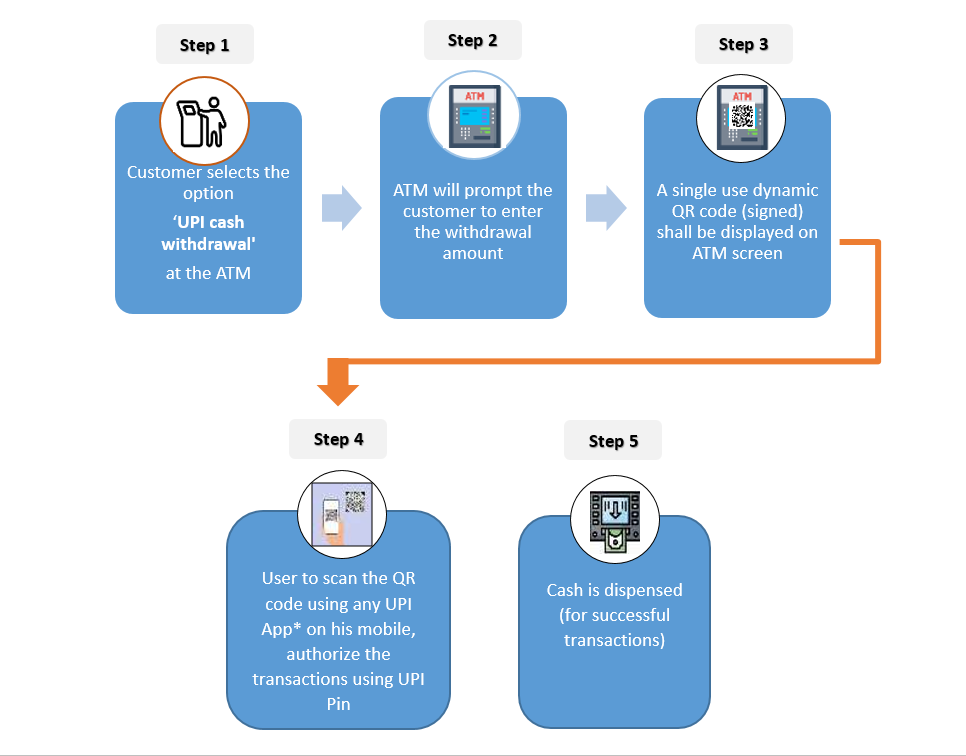

How Does UPI-ATM Cash Withdrawal Work?

- Select UPI Cash Withdrawal: At the ATM, choose the ‘UPI cash withdrawal’ option.

- Enter the Withdrawal Amount: Input the desired amount (up to ₹10,000 per transaction).

- Scan the QR Code: A unique QR code will appear on the ATM screen. Use your UPI-enabled app to scan the code.

- Authorize the Transaction: Confirm the transaction by entering your UPI PIN.

- Receive Cash: Once authorized, the ATM will dispense the cash.

Customer journey :

Key Features of UPI-ATM Cash Withdrawal:

- Interoperability: Withdraw cash from any participating bank’s UPI-enabled ATM.

- Cardless Transactions: No need for a physical ATM card, reducing the risk of card-related fraud.

- Transaction Limits: Withdraw up to ₹10,000 per transaction, subject to your UPI daily limit.

- Multiple Accounts: Withdraw cash from various bank accounts linked to your UPI app.

List of Banks/WLAOs and UPI APPs enabled for offering UPI-ATM services – UPI cash withdrawal

| No. | Bank Name | Issuer | Acquirer | UPI APP |

|---|---|---|---|---|

| 1 | BHIM UPI App | – | – | Live |

| 2 | State Bank of India | Live | Live | Live |

| 3 | ICICI Bank | Live | Pilot Live | – |

| 4 | Indusind Bank | Live | Live | Live |

| 5 | Punjab National Bank | Live | Live | – |

| 6 | Union Bank Of India | Live | Live | Live |

| 7 | Canara Bank | Live | Pilot Live | Live |

| 8 | Bank of Baroda | Live | Live | Live |

| 9 | Central Bank of India | Live | Live | Live |

| 10 | Bank Of India | Live | Live | Live |

| 11 | Indian Overseas Bank | Live | Live | Live |

| 12 | UCO Bank | Live | – | – |

| 13 | Indian Bank | Live | Live | – |

| 14 | Federal Bank | Live | – | – |

| 15 | Punjab and Sind Bank | Live | Pilot Live | – |

| 16 | Karur Vysya Bank | Live | – | – |

| 17 | Yes Bank Ltd | Live | Live | Live |

| 18 | City Union Bank | Live | Live | Live |

| 19 | Karnataka Bank | Live | – | – |

| 20 | HSBC Bank | Live | – | Live |

| 21 | Fincare Small Finance Bank Ltd | Live | – | – |

| 22 | Equitas Small Finance Bank Ltd. | Live | – | – |

| 23 | Ujjivan Small Finance Bank Ltd. | Live | – | – |

| 24 | Suryoday Small Finance Bank Ltd. | Live | – | – |

| 25 | UTKARSH Small Finance Bank | Live | Pilot Live | Live |

| 26 | Hitachi Payment Services Pvt Ltd | NA | Live | – |

UPI-ATM Interoperable Cash Deposit (ICD)

The UPI-ATM Interoperable Cash Deposit (ICD) service allows users to deposit cash into their own or another account without a card. By leveraging UPI technology, this service offers more flexibility, allowing customers to deposit funds into any bank account using mobile numbers, Virtual Payment Addresses (VPA), or account numbers with IFSC.

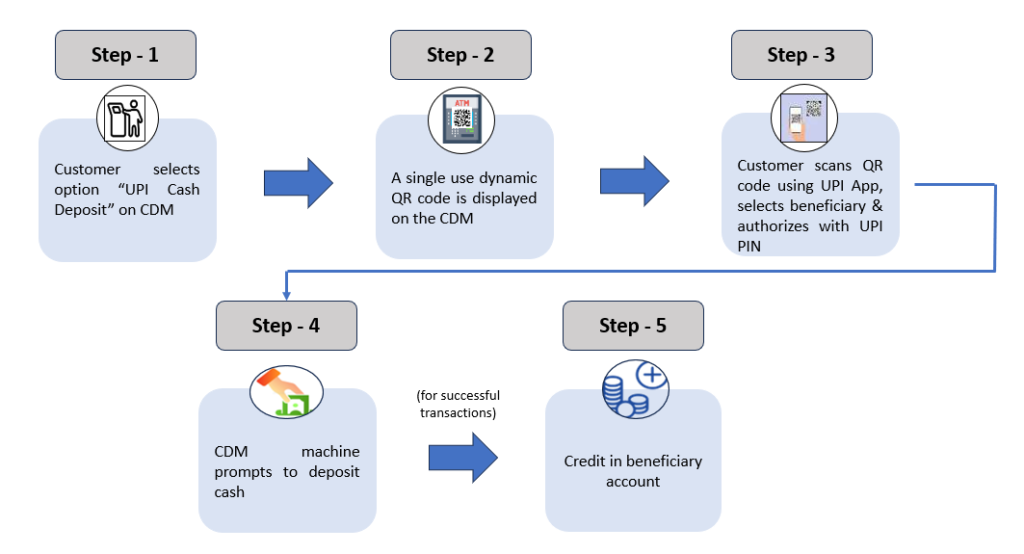

How Does UPI-ICD Work?

- Select UPI Cash Deposit: Choose the ‘UPI cash deposit’ option on the cash recycler machine (CDM).

- Scan the QR Code: The CDM generates a unique QR code, which you scan using your UPI-enabled app.

- Choose Beneficiary: Select the recipient account using their mobile number, VPA, or bank account details (account number + IFSC).

- Authorize the Transaction: Confirm the details and authorize the deposit using your UPI PIN.

- Deposit Cash: Insert the cash into the machine, which verifies and credits it to the beneficiary’s account.

Customer journey :

Key Features of UPI-ICD:

- Interoperability: Deposit cash into any UPI-enabled bank account, even if it’s a third-party account.

- Cardless Deposits: No need for a physical card to deposit cash.

- Higher Transaction Limits: Deposit up to ₹50,000 per transaction (depending on the bank’s policy).

- Third-Party Deposits: Make deposits into another person’s account using just their mobile number, VPA, or account details.

Why UPI-ATM Services Matter

UPI-ATM services bring a new level of convenience and security to banking by allowing cardless transactions. With cardless cash withdrawals and cardless deposits, users no longer need to worry about lost or stolen cards, or fraud caused by card skimming.

Additionally, interoperability means customers are not limited to their own bank’s ATMs and CDMs. They can use any participating bank’s ATM or CDM, making UPI-ATM services widely accessible and user-friendly. This increased flexibility is especially beneficial for those traveling or needing access to their accounts while away from home.

Key Benefits of UPI-ATM Services

- Security: Cardless transactions reduce the risk of card theft and skimming.

- Convenience: No need to carry a physical ATM card; just use your smartphone’s UPI app.

- Wider Accessibility: With interoperable services, you can withdraw or deposit money at any participating bank’s ATM or CDM.

- Multiple Accounts: Easily access funds from different bank accounts linked to your UPI app.

How UPI-ATM Services Support Digital India

The introduction of UPI-ATM services aligns with India’s push towards becoming a cashless and digital economy. By making everyday banking transactions more accessible, secure, and convenient, UPI-ATM services have the potential to greatly reduce reliance on physical cards and traditional banking methods. This move is a significant step forward in modernizing India’s banking infrastructure and supporting the Digital India initiative.

Conclusion

UPI-ATM services for cash withdrawal and deposit are transforming how we interact with ATMs and banks. By offering cardless, secure, and interoperable solutions, NPCI is providing an easy, efficient, and reliable way to manage cash transactions. Whether you’re withdrawing cash without a card or depositing money into a third-party account, UPI-ATM services are reshaping banking convenience.

As this service gains more adoption, it’s poised to become the new standard for ATM transactions in India. If you’re already using UPI for payments, you’re just one step away from experiencing the convenience of UPI-ATM services.

FAQs on UPI-ATM Cash Withdrawal and Deposit

- What is the maximum limit for UPI-ATM cash withdrawals? The limit is ₹10,000 per transaction, but it depends on your daily UPI transaction limit set by your bank.

- Can I use any UPI app for UPI-ATM services? You can use any UPI app that supports UPI-ATM transactions. Ensure your app is updated with the latest features.

- Is UPI-ICD available for third-party deposits? Yes, you can deposit money into another person’s account using their mobile number, VPA, or account number and IFSC code.