![]()

The Adani Group, led by Indian billionaire Gautam Adani, is currently under investigation by US authorities over allegations of bribery, fraud, and misleading US investors. Below is a clear and comprehensive description of the case to understand its key elements:

Nature of the Investigation

The US Department of Justice (DOJ) and the US Attorney’s Office for the Eastern District of New York are investigating claims that the Adani Group or its affiliates engaged in corrupt conduct. Specifically, the allegations reveals:

For detailed insights into the recent indictment of a billionaire chairman of a major conglomerate and seven senior business executives on charges of fraud and corruption, you can read the official statement from the U.S. Department of Justice here. This report outlines the specific allegations, legal context, and broader implications of the case.

Key Allegations

Bribery and Corruption:

- The Adani Group is suspected of bribing Indian officials to gain preferential treatment for energy projects.

- These allegations suggest that such corrupt practices may have helped the group secure lucrative contracts or approvals, bypassing standard regulatory and competitive procedures.

- Bribery allegations also extend to other entities linked to Adani, such as Azure Power Global, a renewable energy company.

Fraudulent Practices:

- Investigators are examining whether the Adani Group engaged in fraudulent financial activities to mislead American investors.

- The fraud might involve inflating financial statements, hiding debts, or misrepresenting the true financial health of the company.

Misrepresentation to U.S. Investors:

- As Adani Group entities attract investments from U.S.-based institutions, the investigation seeks to determine if these investors were provided with false or incomplete information.

- Misrepresentation violates U.S. securities laws and can lead to severe penalties, including fines and restrictions on operations.

Who is Leading the Investigation?

- U.S. Department of Justice (DOJ):

- The DOJ, through its fraud division, is investigating whether the actions of the Adani Group or its affiliates violate anti-bribery and anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA).

- The FCPA makes it illegal for U.S.-linked entities or their affiliates to bribe foreign officials.

- U.S. Attorney’s Office (Eastern District of New York):

- This office is involved in probing the specifics of the Adani case, particularly its implications for U.S.-based investors.

- Securities and Exchange Commission (SEC):

- The SEC is looking into whether the Adani Group followed disclosure norms and securities regulations while courting American investors.

- It focuses on any inconsistencies or omissions in financial reports shared with the U.S. markets.

The investigation also involves another Indian company, Azure Power Global, a renewable energy firm. Authorities are looking into whether Azure and the Adani Group used illicit methods to secure business advantages.

Hindenburg Research Allegations

The current U.S. investigation follows a damning report released by Hindenburg Research, a U.S.-based short-seller, in January 2023. The report accused the Adani Group of:

- Stock Manipulation: Artificially inflating the value of its listed companies.

- Accounting Irregularities: Engaging in fraudulent financial practices.

- Improper Use of Tax Havens: Moving money through offshore entities to obscure financial dealings.

- Money Laundering: Allegations of routing funds through a network of shell companies.

Hindenburg described the Adani Group’s activities as “the largest con in corporate history.” While the Adani Group dismissed these claims, the report caused a massive decline in the market value of Adani’s companies, wiping out over $100 billion in investor wealth.

Why is this Investigation Significant?

- Global Financial Integrity:

- The Adani Group is a multinational conglomerate with a presence in sectors like energy, infrastructure, and ports. Its operations span multiple countries, making any allegations of malpractice a global concern.

- Impact on U.S. Markets:

- Many institutional investors in the U.S. have stakes in Adani-related securities. Any fraudulent activity affecting these investments could lead to significant losses for American investors.

- Compliance with International Laws:

- As a global player, Adani is expected to comply with anti-corruption laws, including the U.S. FCPA, which has strict regulations against bribery and fraud.

U.S. Regulatory Actions

The U.S. Securities and Exchange Commission (SEC) is reportedly conducting a parallel investigation. The SEC’s focus is likely on:

- Whether the Adani Group complied with U.S. securities laws.

- Any potential misrepresentation of facts to American investors who hold stakes in Adani entities.

Indian Regulatory Context

In India, the Adani Group has also faced scrutiny:

- Securities and Exchange Board of India (SEBI): SEBI has been investigating allegations of money laundering, round-tripping of funds, and regulatory violations.

- Supreme Court Oversight: Indian courts have been petitioned to monitor investigations into Adani. However, no regulatory failure by SEBI has been officially established so far.

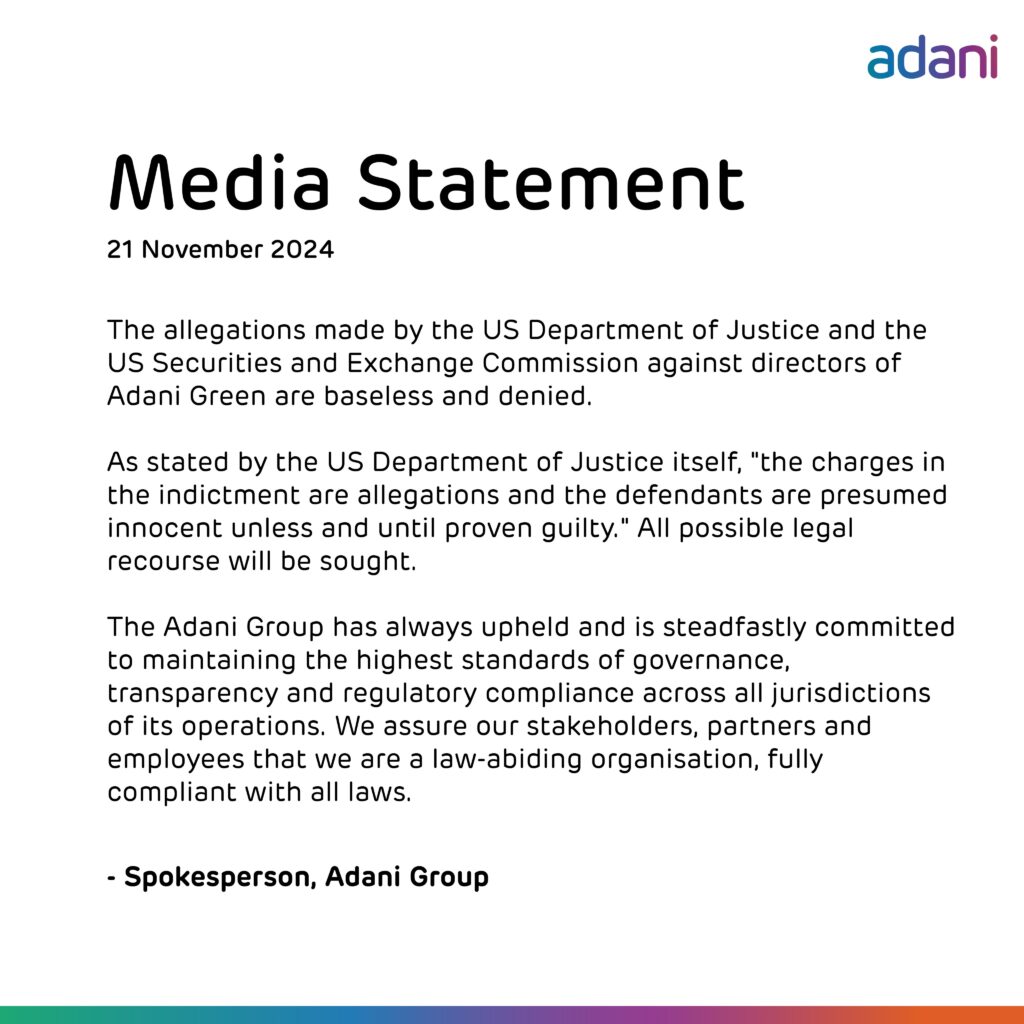

Adani Group’s Response

“The Adani Group has categorically denied all allegations. A spokesperson for the group stated that they are unaware of any U.S. investigations against its chairman, Gautam Adani. The company also labeled the Hindenburg report as “baseless” and politically motivated.“

The group maintains that its business dealings are ethical and in compliance with all applicable laws, both in India and abroad

Broader Implications

The case holds significant implications:

- Investor Confidence: Allegations of corporate fraud undermine trust among investors, both in India and internationally.

- Political and Economic Ramifications: The Adani Group’s close ties with the Indian government add a political dimension to the case.

- Corporate Governance: The case raises broader questions about the governance of Indian conglomerates and their accountability in global markets.

Current Status

The investigation is ongoing, and no formal charges have been filed against Gautam Adani or his group at this stage.

The Adani Group continues to deny any wrongdoing, stating they are unaware of any such investigations against their chairman.

Conclusion

The investigation into the Adani Group is ongoing, and its outcome could have far-reaching consequences for both the company and India’s corporate image. While the group continues to deny wrongdoing, U.S. authorities and regulatory bodies are pursuing rigorous scrutiny.

This case underscores the importance of transparency, ethical practices, and regulatory compliance in corporate operations globally. Further updates are expected as investigations progress.